maryland student loan tax credit amount

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. Have maintained the residency of Maryland from 2019 tax year.

Although There Are Lots Of Financial Reasons For Marriage Bonnie Koo Md Believes It Sometimes Makes Sen Reasons For Marriage Family Matters Unmarried Couples

And 2 solely for the repayment of the undergraduate andor graduate student loan debt described on this application.

. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund. 1 within two y ears after the taxable year in which the credit is claimed. The amount of any tax credit approved by the Maryland Higher Education Commission may not exceed 5000.

MARYLAND FORM 502CR INCOME TAX CREDITS FOR INDIVIDUALS Attach to your tax return. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund.

To be considered for the tax credit applicants must complete the application and submit student loan. Anyone received their student loan tax credit amount notification. From July 1 2022 through September 15 2022.

I agree and promise to use the full amount of any Student Loan Debt Relief Tax Credit that is granted to me. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. One has acquired up to 20000 or more for the graduate or undergraduate student debt loan or both. File Maryland State Income Taxes for the 2019 year.

The amount of any tax credit approved by the Maryland Higher Education Commission may not exceed 5000. I got mine today it seems my credit amount will be 883. 3 For any taxable year the total amount of credits approved by the Commission under this section may not exceed 9000000.

If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. The refundable tax credit must be claimed against the State income tax for the taxable year in which the Maryland Higher Education Commission certifies the tax credit. Administered by the Maryland Higher Education Commission MHEC the credit provides a refundable tax credit cash payment that a tax filer applies directly to their student loan balance.

2 By December 15 of each year the Commission shall certify to the individual the amount of any tax credit approved by the Commission under this section not to exceed 5000. There were 5145 applicants who attended in-state institutions and will. Tax-General Article of the Annotated Code of Maryland.

Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return.

The refundable tax credit must be claimed against the State income tax for the taxable year in which the Maryland. Complete the Student Loan Debt Relief Tax Credit application. Submitted an application to the MHEC by September 15 2019.

Enter here and on Part AA line 7. This is my first year applying but I understand last year the average credit was 1200 last year I just heard about it too late. For more information visit Student Loan Debt Relief Tax.

I agree and promise to use the full amount of any Student Loan Debt Relief Tax Credit that is granted to me. The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference.

Incurred at least 20000 in total student loan debt. One has at least 5000 for outstanding graduate or undergraduate student debt loans or both while applying the application to receive the credit. The application period is July 1 to September 22 of.

1 within two years after the taxable year in which the credit is claimed. I probably spent that in billable hours applying for the thing so Im a little disappointed. To qualify for the Student Loan Debt Relief Tax Credit you must.

There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. COMRAD-012 2021 Page 3 NAME SSN PART G - VENISON DONATION - FEED THE HUNGRY ORGANIZATIONS TAX CREDIT 1. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an.

I agree and promise to use the full amount of any Student Loan Debt Relief Tax Credit that is granted to me. Enter the amount up to 50 per deer of qualified expenses to butcher and process an antlerless deer for human consumption. And 2 solely for the repayment of the undergraduate andor graduate student loan debt described on this application.

And 2 solely for the repayment of the undergraduate andor graduate student loan debt described on this application. 1 within two y ears after the taxable year in which the credit is claimed. The tax credits were divided into two groups of eligibility including Maryland residents who attended a Maryland institution and Maryland residents who attended an out-of-state institution.

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Net Worth Update March 2018 Future Proof M D Net Worth Emergency Fund Worth

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Net Worth Update September 2017 Future Proof M D Emergency Fund September Net Worth

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Maryland Student Loans And Financial Aid Programs

Maryland Student Loan Forgiveness Programs Student Loan Planner

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

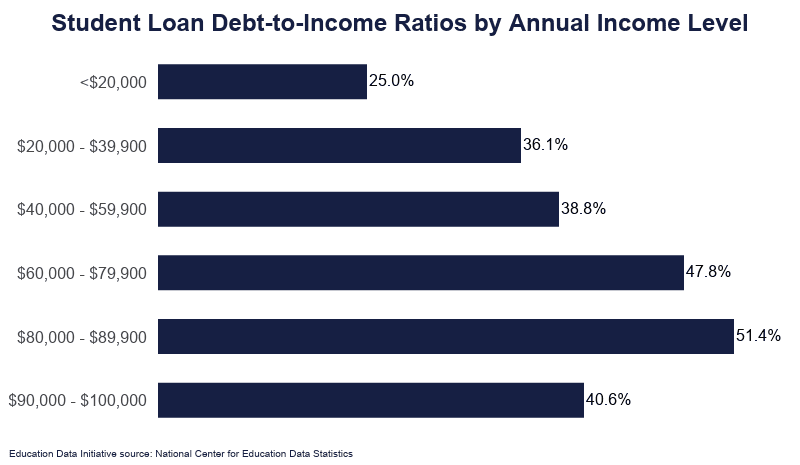

Student Loan Debt By Income Level 2022 Data Analysis

Fire Esquire Financial Independence Personal Finance Finance

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

How To Go From Md To Real Estate Magnate Cash Flow Wealthy Doc Real Student Encouragement Wealth Building

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Banks Pare Student Loan Exposure Business Line Student Loans Student Exposure